Paying a Premium on your First Deal

On the importance of paying a premium on your first successful deal

I have been mulling on a concept for some time now that I would like to share with the world. I find that writing brings clarity to my thoughts. This concept is what I like to call paying the Premium on your first Deal when executing your first deal|event. It’s an idea that I have observed from studying successful people. Paying a premium means paying more than the actual value of an item/company/thing. It’s typically done to elevate one from one’s current level in life to a new level.

By price, I do not money only. By price I mean money, time and effort - physical and mental. This means that one can say that I paid a mental premium on executing a deal|event and that I paid a time premium on executing a thing/deal.

By deal|event I mean events like buying your first company|house, inventing a new drug, getting into an Ivy league university, being the first person from your sub category to achieve a thing and many other things. Paying the premium on your first deal means moving from a lower state to a higher state. This move is relative to each individual.

The common underlying theme behind executing this event|deal is that by executing and achieving this deal, it becomes a landmark on your life. An event that one can look back as being a catalyst to one’s success. Over the next couple of lines, I am going to expand upon my idea using two examples from real life entrepreneurs.

Exhibit One:

The gaining of independence by John D Rockefeller in 1865 from the Clark brothers.

In 1865, John D Rockefeller, a partner in the firm Andrews, Clark & Co. Rockefeller - formed for the oil business in 1863 - decided that he had enough of the insults and belittling from the Clark brothers and that he was going to buy out the Clarks from the partnership. The insults came because Rockefeller’s was seen as being just an ordinary keeper of books and ledgers and because he was taking out loans to aggressively expand the refinery business.

The opportunity to buy out the Clark brothers came on the 1st of February, 1865 when the Clarks became vigorously opposed to Rockefeller’s intention of expanding the refinery capacity. The result of this opposition was that James Clark told Rockefeller that they better split up; A suggestion that Rockefeller silently wanted.

The following morning, Rockefeller quickly and silently filed a notice of dissolving the partnership at the Cleveland Leader newspaper. The Clarks, Sam Andrew and Rockefeller agreed to auction Andrews, Clark & Co. Rockefeller to the highest bidder amongst themselves. During the auction, Rockefeller offered the winning bid of $72,000, beating the Clark brothers to the right to acquire ownership of the partnership.

The winning bid was way more than Rockefeller valued the refinery business. However, he executed upon it. This is what I mean by paying the premium on your first deal. The refinery was the largest in Cleveland and one of the largest in the world at that time.

The firm was now called Rockefeller and Andrews as announced in the Cleveland Leader on the 15th of February, 1865. Rockefeller also dissolved the Clark and Rockefeller partnership - formed in 1859 for the purpose of conducting the commissions business - he had with Maurice Clark.

Let’s take a quick mental check of some of the key points and insights.

What did Rockefeller gain by buying out the Clarks?

At 25, he had won control of Cleveland’s largest refinery which had a capacity twice the size of the second largest refinery.

He gained business independence from the Clark brothers.

What premium did Rockefeller pay?

The winning bid of $72,000 was about $22,000 more than what Rockefeller had valued the refining business as.

Rockefeller also had to surrender his interest in the Clark and Rockefeller partnership.

Why did Rockefeller have to pay a premium?

He wanted to gain independence.

He was relatively young.

He was thought of being an ordinary bookkeeper by the Clark brothers.

Exhibit Two:

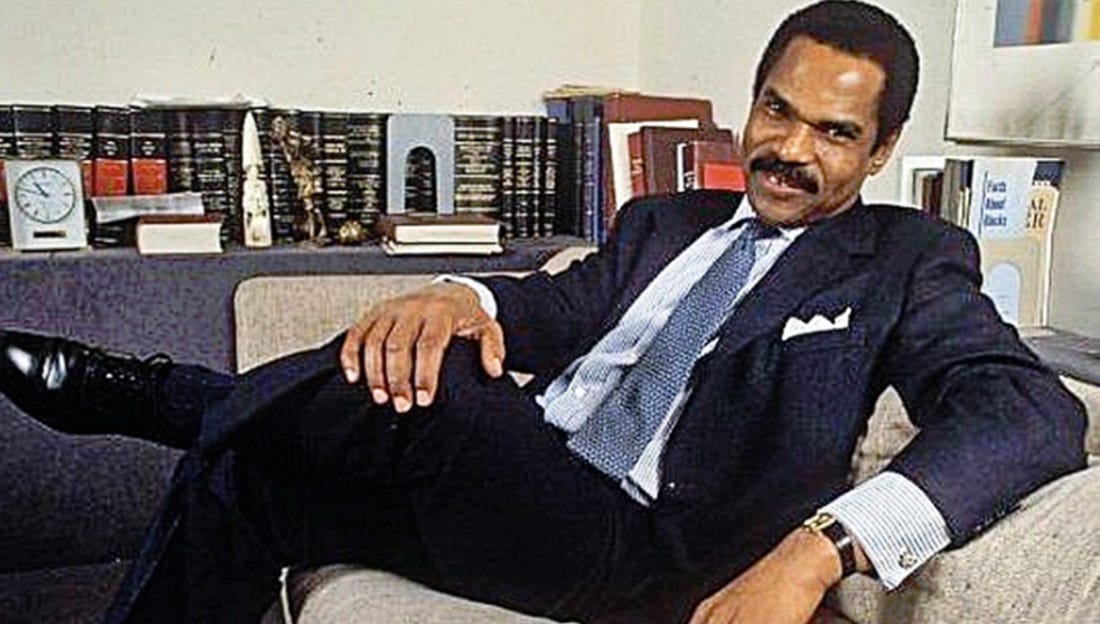

Reginald F Lewis first successful acquisition of a company - Pattern Co- in 1984 using leveraged buyout

In 1983, Norton Simon Industries - a holding company owned by American Billionaire Norton Simon- was acquired in a hostile takeover by Esmark. One of the companies that existed under the parent holding company was McCall Pattern co - a 113 year old maker of home sewing patterns. After the acquisition, an article in Fortune had a quote from Don Kelly, the head of Esmark at the time, which said that McCall Pattern didn’t fit into the long term plans of Esmark. It was this article that caught the attention of a hungry and twice bitten Reginald F Lewis.

First who is Reginald Lewis? Reginald Lewis was an American business man and Harvard trained lawyer. Lewis was one of those entrepreneurs who used leveraged buyouts in the 1980s to buy companies, increase the value of those companies and sell them for profit. Lewis was the first African American to build a billion dollar company.

When Lewis came across the article in Fortune in 1983, his brain lit up to try acquire McCall Pattern co. This was coming on the back of his failures to acquire Parks Sausage business in 1975, Almet in 1977 and St Croix station in 1982. On reading the article, Lewis made up his mind that this was going to be his first successful leveraged buyout acquisition.

.

Lewis put together his team to acquire McCall Pattern and started his campaign on July 29, 1983. This campaign involved things such as building an understanding of McCalls business, winning over the top manager - Earle Angstadt - at McCall Pattern, raising finance and valuing the business. The quote below shows how Lewis valued McCall Pattern.

McCall was earning about $6 million in operating profit. This was a figure I would repeat often. The fact is, however, I never focused on earnings. Others like to hear it so I repeated it, but I kept my eyes glued on cash flow. When I worked through the numbers, over a 2½-year period NSI had pulled about $18 million in cash out of McCall. That, then, was my price—$18 million.

After valuing the business and discussing with Phyllis Schless of Bear Sterns, Schless advised him that he had to make an offer higher than any other competitor. He basically had to offer a premium. This ties in with the concept of this post - Premium on your first deal.

The fact that Lewis was an unknown quantity and came from a demographic that was not associated with high powered deals at the time required that he pay a premium on the price on McCall Pattern. This event also ties in with the earlier example of John D Rockefeller who paid a premium to the Clark brothers to gain independence.

On January 29, 1984, Lewis and his team closed the deal with the Playtex team representing McCall for the amount of $22.5 million of which Bankers Trust provided $19 million. The winning bid was $4.5 million greater than worth Lewis valued McCall Pattern at.

Let’s take a quick mental check of some of the key points and insights.

What did Lewis gain by doing this deal?

He became an owner of an American business through executing a deal on Wall Street.

He gained a reputation as someone who could execute high powered deals.

In his own words, “The McCall deal really laid the groundwork for our next transaction because it gave us credibility in the marketplace,” The next transaction was his acquisition of Beatrice Internal Food. The biggest in his illustrious career.

He increased his net-worth.

He positioned himself as someone who could successful acquire companies

What premium did Lewis pay on this deal?

He paid $4.5 million more than the business was worth.

It took him 9 months of emotional, mental and physical pain to execute the deal.

He could not openly come out as being the lead investor for the leveraged buyout until when the deal was more of less completed.

Why did Lewis pay the premium?

He was an unknown quantity in the high powered deal making game.

He didn’t come from the traditional background for high finance.

Conclusion

My thesis Premium on your first Deal is a work in progress. This post is just an introduction that I reckon will change with time. I am also open to the fact that I might be wrong and I am happy to be corrected.

I really hope that you have enjoyed reading this post and learnt a thing or two. If you like my writing and want to be the first to be notified when new posts come out, please sign up below.

If you like to learn more about leveraged buyouts, I can’t recommend this book enough, Kings of Capital by David Carey and John Morris. To learn more about Rockefeller, I highly recommend reading Titan by Ron Chernow.

If you have enjoyed reading this post from leverage thoughts, smash the subscribe button below to receive notifications in your email when new posts are published.

Don’t enjoy the contents alone. Share it with your friends and family to enable them participate in the leverage thoughts family.

Don’t keep your thoughts about this article to yourself. Share it with the world in the comments section.

Thanks for sharing this! Based on your piece I now have a new set of questions I need to ask myself regularly: what new skills, funds, networks or other resources am I now acquiring that will make up the premium I need to pay to get to the next level?

Wow. This is quite insightful.